Credit Reports Explained: Your Path to Financial Wellness with Our Templates

Ever wondered what goes on behind the scenes when you apply for a loan, a credit card, or even a new apartment? The answer lies in your credit report – a comprehensive summary of your financial history. But navigating this world can feel daunting. That’s where we come in.

At https://creditreportgenerator.net we’re dedicated to empowering you with the knowledge and resources you need to understand your financial landscape. We offer a suite of educational tools, including a Credit Report Generator, to help you demystify complex financial documents and processes. Think of us as your friendly guide to financial literacy.

This article will explore the ins and outs of credit reports, explain why they matter, and introduce you to the valuable resources available on CreditReportGenerator.net. We’ll also delve into our other helpful tools, such as our payslip generator, tax return generator, and bank statement generator, all designed to make your financial journey a little smoother.

In addition to credit reports, it’s important to be familiar with other key financial documents. For more information on understanding your banking activity, you can also check our Bank Statement Generator, which allows you to create sample statements.

Cracking the Code: What’s in a Credit Report?

Imagine your credit report as a financial resume. It tells lenders and other interested parties how you’ve handled credit in the past. It’s compiled by credit bureaus, which are like record-keeping companies for your financial activity. In the US, the big three are:

- Equifax

- Experian

- TransUnion

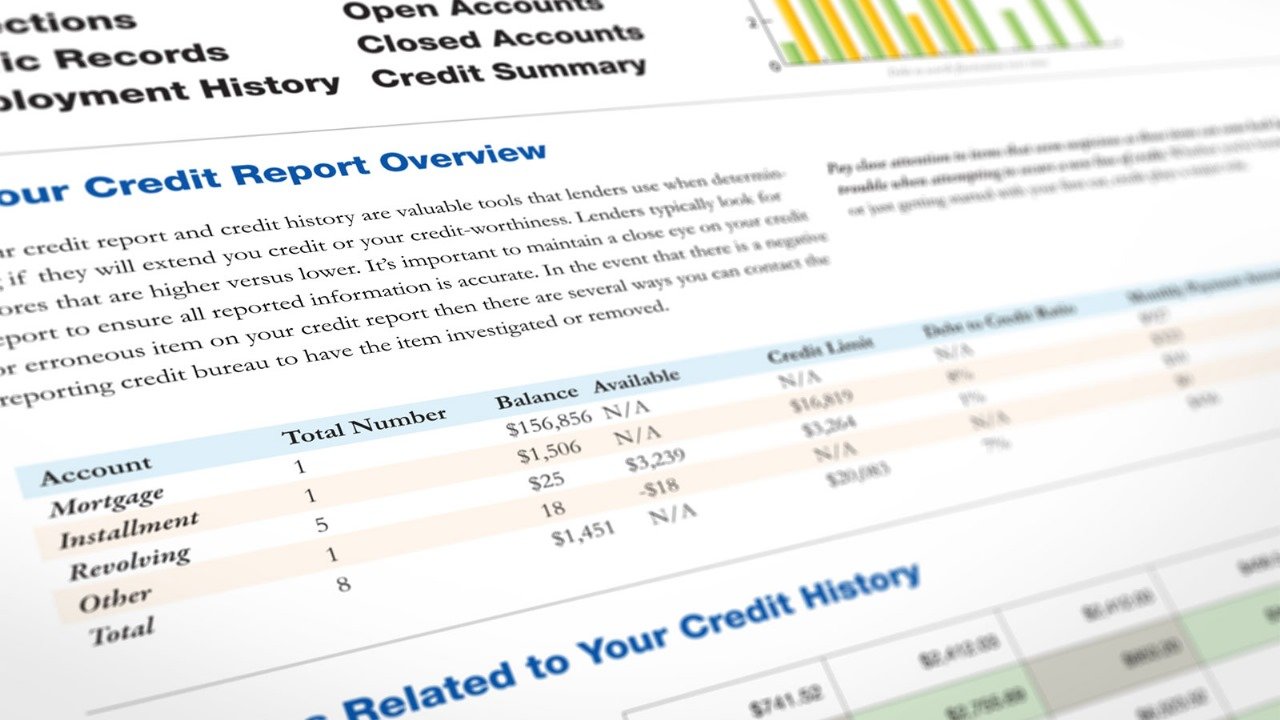

These bureaus collect information from various sources to paint a picture of your credit behavior. Here’s what you’ll typically find in a credit report:

- Your Personal Details: This includes your name, address, Social Security number (or other identification), birth date, and employment history. It’s the basic info that identifies you.

- Credit Account Chronicles: This section lists all your credit accounts, such as credit cards, loans (auto, student, mortgage), and lines of credit. For each account, you’ll see details like the account number, credit limit, current balance, payment history, and whether the account is open or closed.

- The Payment Timeline: This is where the report card comes in. It shows whether you’ve made your payments on time. Late payments are a big red flag to lenders and can significantly hurt your credit score.

- Public Record Rundown: This section includes information from public records that can affect your creditworthiness, such as bankruptcies, tax liens (unpaid taxes), and judgments (court orders to pay a debt).

- Credit Check Log: This is a record of who has accessed your credit report. There are two types:

- Hard Inquiries: These happen when you apply for new credit, like a loan or credit card. Too many hard inquiries in a short time can ding your score.

- Soft Inquiries: These are for informational purposes, like when you check your own credit or when a company sends you a pre-approved credit offer. Soft inquiries don’t affect your score.

Why Should You Care About Your Credit Report? (It’s More Than Just Loans)

Your credit report is a key that unlocks many financial opportunities. It’s not just about getting a credit card; it impacts various aspects of your life:

- Loan Approval: Lenders use your credit report to decide if they’ll lend you money for a car, a house, or other big purchases.

- Interest Rate Perks: A good credit report can score you lower interest rates on loans and credit cards, saving you a ton of money in the long run.

- Apartment Hunting Advantage: Landlords often check credit reports to see if you’re a reliable tenant who pays their bills.

- Job Market Edge: Some employers, especially in finance or security-sensitive fields, might peek at your credit report as part of the hiring process.

- Insurance Savings: Believe it or not, insurance companies sometimes use credit reports to determine your premiums.

Decoding Your Credit Score: The Numbers Behind the Report

While your credit report provides the raw data, your credit score is a three-digit number that summarizes your creditworthiness. It’s calculated from the information in your report. The most common scoring model is the FICO score, which ranges from 300 to 850. The higher your score, the better your credit.

What Makes Up Your Credit Score?

Here’s a breakdown of the factors that influence your credit score:

- Payment History (35%): This is the biggest ingredient. Paying your bills on time, every time, is crucial.

- Amounts Owed (30%): This is how much debt you have compared to your available credit. Maxing out your credit cards is a no-no.

- Credit History Length (15%): Lenders like to see a long track record of responsible credit use.

- New Credit (10%): Opening lots of new accounts quickly can raise red flags.

- Credit Mix (10%): Having a variety of credit types (credit cards, loans) can be a plus.

CreditReportGenerator.net: Your Hub for Financial Templates

Now, let’s talk about how CreditReportGenerator.net can help you on your financial journey. We’re not a credit reporting agency; instead, we provide educational templates to help you understand various financial documents.

Think of us as your study aid for the world of finance. We offer tools to help you get familiar with the look and feel of important documents, so you’re better prepared when you encounter the real thing.

Our Toolkit: More Than Just Credit Report Templates

Beyond credit report examples, we offer a range of templates to help you understand other key financial documents:

- Credit Report Generator: This tool lets you create sample credit reports. It’s a great way to get comfortable with the layout and information in a credit report, so you can easily spot what’s important.

- Payslip Generator: Ever wonder how your paycheck is calculated? Our Payslip Generator lets you create sample payslips, showing you how deductions like taxes and insurance affect your take-home pay.

- Tax Return Generator: Taxes can be confusing. Our Tax Return Generator helps you create sample tax returns, giving you a glimpse into the forms and information involved in filing your taxes.

- Bank Statement Generator: Bank statements can be dense. Our Bank Statement Generator lets you create sample statements to help you understand how your transactions are recorded and how to reconcile your accounts.

Why Use a Credit Report template?

Our website is designed to empower you with financial knowledge. By using our templates, you can:

- Get Comfortable with Financial Documents: We help you take the mystery out of documents like credit reports, payslips, and tax returns.

- Understand the Flow of Information: See how data is organized and presented in these documents.

- Become a Savvy Financial Consumer: Arm yourself with the knowledge to make informed decisions about your money.

- Boost Your Financial Confidence: Feel more in control when dealing with your finances.

A Word of Caution: Our Templates Are for Education Only

It’s super important to remember that the documents you create on CreditReportGenerator.net are for educational purposes only. They are not official documents and cannot be used for any legal or financial transactions. Always refer to official sources for your real financial information.

Protecting Your Real Credit: A Few Tips

While you’re using our site to learn, here are some tips to keep your actual credit healthy:

- Pay Bills on Time: This is the golden rule. Late payments are a major credit killer.

- Keep Credit Use Low: Don’t max out your credit cards. Aim to use only a small portion of your available credit.

- Check Your Real Credit Reports: Get your free reports from AnnualCreditReport.com regularly to check for errors or signs of fraud.

- Be Smart About New Credit: Don’t apply for a bunch of new credit accounts at once.

- Build a Credit History: The longer you’ve used credit responsibly, the better.

Your Credit, Your Future: Take Control with Knowledge

Your credit report is a powerful tool that influences your financial well-being. Understanding it is the first step to managing it effectively. CreditReportGenerator.net is here to provide you with the educational resources you need to navigate the world of credit and finance with confidence. Explore our templates, empower yourself with knowledge, and take control of your financial future.