How ESG Analytics Providers are Shaping Corporate Sustainability Strategies

In recent years, the focus on sustainability has surged, compelling businesses to integrate Environmental, Social, and Governance (ESG) principles into their core strategies. ESG analytics providers play a pivotal role in this transformation, offering tools and insights that help companies not only comply with regulations but also lead in sustainability practices. This blog delves into how ESG analytics providers are reshaping corporate sustainability strategies and the impact of their solutions on businesses worldwide.

Understanding ESG Analytics Providers

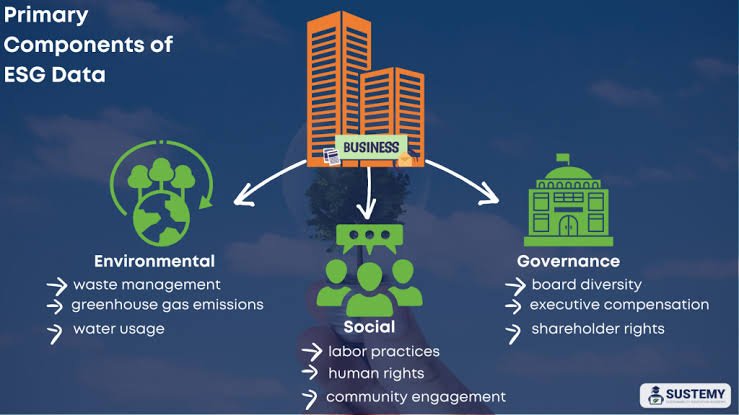

ESG analytics providers specialize in collecting, analyzing, and interpreting data related to environmental impact, social responsibility, and governance practices. Their services range from detailed reports and scorecards to real-time dashboards, offering a comprehensive view of a company’s ESG performance. These providers leverage advanced technologies and data management systems to deliver actionable insights that drive strategic decisions.

The Role of ESG Analytics Providers

1. Data-Driven Decision Making

One of the most significant contributions of ESG analytics providers is enabling data-driven decision-making. By utilizing sophisticated data management systems, these providers offer businesses a granular view of their ESG metrics. This data is crucial for identifying areas of improvement, setting benchmarks, and tracking progress over time. For instance, a company might use ESG analytics to assess its carbon footprint, social impact, and governance practices, leading to more informed and strategic sustainability initiatives.

2. Enhancing Transparency and Reporting

Transparency is a cornerstone of effective sustainability strategies. ESG analytics providers help companies enhance their transparency by offering detailed reporting tools that align with global standards and frameworks. This includes generating reports that meet the requirements of frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB). Such comprehensive reporting not only boosts credibility but also strengthens investor confidence and stakeholder trust.

3. Identifying Risks and Opportunities

Effective risk management is integral to sustainability. ESG analytics providers use predictive analytics and trend analysis to help companies identify potential risks and opportunities related to ESG factors. For example, they might analyze data to forecast environmental risks due to regulatory changes or supply chain disruptions. This proactive approach enables companies to mitigate risks early and seize opportunities for sustainable growth.

4. Driving Strategic Planning

Strategic planning in sustainability requires a deep understanding of various ESG factors. ESG analytics providers assist businesses in developing and refining their sustainability strategies by offering insights into industry benchmarks, best practices, and emerging trends. This strategic guidance helps companies align their sustainability goals with their overall business objectives, leading to more coherent and impactful sustainability plans.

5. Improving Stakeholder Engagement

Engaging stakeholders effectively is crucial for successful sustainability initiatives. ESG analytics providers support this by offering tools that help companies communicate their ESG performance to stakeholders in a clear and compelling manner. Whether through interactive dashboards, visualizations, or tailored reports, these tools enable companies to showcase their sustainability efforts and engage with stakeholders on a more meaningful level.

Leveraging Data Management Systems

The efficiency of ESG analytics largely depends on the robustness of data management systems used by providers. These systems ensure the accurate collection, storage, and analysis of ESG data, enabling providers to deliver reliable and actionable insights. Here’s how data management systems contribute to the effectiveness of ESG analytics:

1. Data Integration and Accuracy

Data management systems integrate data from various sources, including internal databases, third-party reports, and real-time sensors. This integration ensures that all relevant ESG data is considered, leading to more accurate and comprehensive analyses. Accurate data is essential for making informed decisions and setting realistic sustainability goals.

2. Real-Time Monitoring and Reporting

With the advent of real-time data management, ESG analytics providers can offer up-to-date insights on ESG performance. This real-time monitoring allows companies to track their progress continuously, identify issues as they arise, and make timely adjustments to their strategies. Real-time reporting also enhances transparency and accountability.

3. Enhanced Data Security

Given the sensitivity of ESG data, robust data management systems incorporate advanced security measures to protect against data breaches and unauthorized access. This security ensures that companies can trust the integrity of their ESG data and maintain compliance with data protection regulations.

4. Scalability and Flexibility

As companies grow and evolve, their ESG data needs may change. Data management systems are designed to be scalable and flexible, accommodating the increasing volume and complexity of data. This scalability ensures that ESG analytics providers can continue to support companies as they expand their sustainability efforts.

Conclusion

ESG analytics providers are instrumental in shaping corporate sustainability strategies by offering valuable insights, enhancing transparency, and supporting data-driven decision-making. Through advanced data management systems, these providers ensure the accuracy, security, and timeliness of ESG data, enabling companies to navigate the complexities of sustainability effectively.

For businesses looking to strengthen their sustainability initiatives and stay ahead in a competitive market, partnering with an experienced ESG analytics provider is a strategic move. By leveraging the power of ESG analytics and robust data management systems, companies can drive meaningful change, achieve their sustainability goals, and build a more resilient and responsible future.