Finding The Right Balance – Should Indicators Be Used Selectively?

Have you lately seen a disorganized trading screen? Indicators proliferating like confetti, each vying for attention, but none providing the clarity essential for your trades? If affirmative, you are not solitary. Numerous traders, particularly novices, succumb to the pitfall of using excessive indicators, anticipating that they would ensure market success. Excessive noise might obscure the melody. Indicators are valid instruments but are most effective when used judiciously and efficiently. Let us examine how to equilibrate the utilization of indicators to augment your trading approach. Indicators can be useful, but relying on too many creates confusion. How do traders determine which ones matter most? Tradynator links investors with educational firms that simplify technical analysis.

When Indicators Complement Market Analysis

Indicators are like the trusty sidekick in a hero’s story – they’re there to support, not to take over. They work best when paired with solid market analysis backed by research. Whether it’s identifying trends, gauging momentum, or confirming patterns, indicators shine when used for specific purposes.

For example:

- Trend-following indicators like moving averages help identify the direction of the market.

- Oscillators such as RSI can spot overbought or oversold conditions.

- Volume indicators offer details about the strength of a price movement.

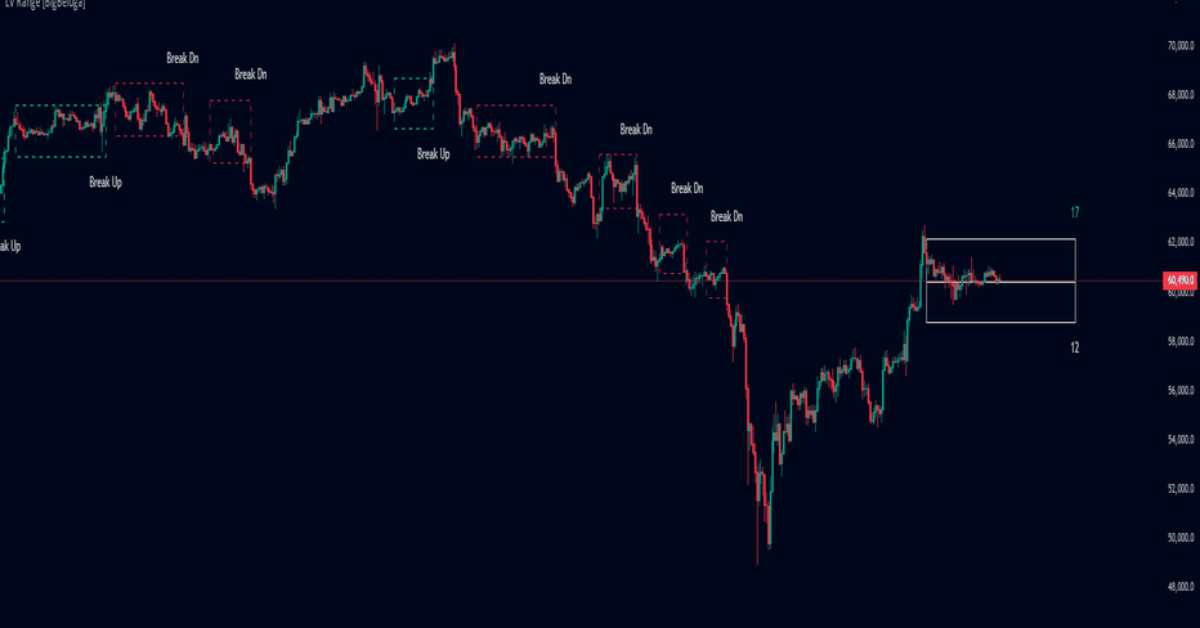

However, avoid relying on them in isolation. Can you spot a chart pattern like a rising wedge? Then use an oscillator to confirm the breakout. By complementing your market analysis with a relevant indicator, you enhance your decision-making without unnecessary clutter.

Filtering Out Noise & Avoiding Indicator Overload

How many indicators are too many? The answer is simple – if your chart looks like an abstract painting, you’re overcomplicating things. Using too many indicators often leads to contradictory signals and, more importantly, confusion.

To cut down the noise:

- Stick to 1 or 2 indicators per trade.

- Choose tools that serve different purposes (e.g., trend vs. momentum indicators).

- Avoid layering indicators that essentially provide the same information.

Imagine this – you’ve got three oscillators lining your chart. Two say buy while one screams sell. Guess what? You’ve just added uncertainty, not value, to your trade. The paradox of choice applies here, and less is definitely more in this scenario.

Pro tip: Don’t get married to an indicator just because everyone on the forum swears by it. Test them with historical data first to find what truly works for your strategy.

Crafting A Minimalist Yet Effective Trading Strategy

The best traders focus on simplicity. The goal isn’t to impress anyone with fancy screen setups – it’s to make smarter trades. A minimalist trading strategy doesn’t just make decisions easier; it also boosts confidence.

Here’s how to create one:

- Pick a Key Indicator for Trends – Moving averages or Bollinger Bands are great here.

- Add a Confirmation Tool for Entries – Examples include RSI or MACD.

- Keep Your Chart Clean – Avoid cluttering your workspace; trade with clarity.

- Rely on Price Action – Indicators can give signals, but price action is king. Learn to read candlestick patterns to understand market sentiment directly.

- Test and Adjust Regularly – Markets evolve, so should your strategy.

Before jumping head-first into trades, ask yourself this – do you really need another indicator? Often the answer is no.

The Balancing Act – Final Thoughts

Indicators are helpful companions, not autopilot systems. Use them with care and intention, and you’ll avoid the trap of over-reliance. Balance is key – too few tools may leave you flying blind, whereas too many will drown you in noise. Selectivity beats quantity every single time. But here’s the catch – trading can’t depend solely on indicators. Always back your decisions with sound research, keep learning about market conditions, and connect with financial experts for better insights.

Stay in touch to get more updates & alerts on VyvyManga! Thank you